When Regulation Rewrites Market Structure

Blockchain University analyzes systems from the inside out — focusing on incentives, structure, and failure modes rather than price or prediction. This piece is a public example of that approach.

Most people think regulation is “rules.”

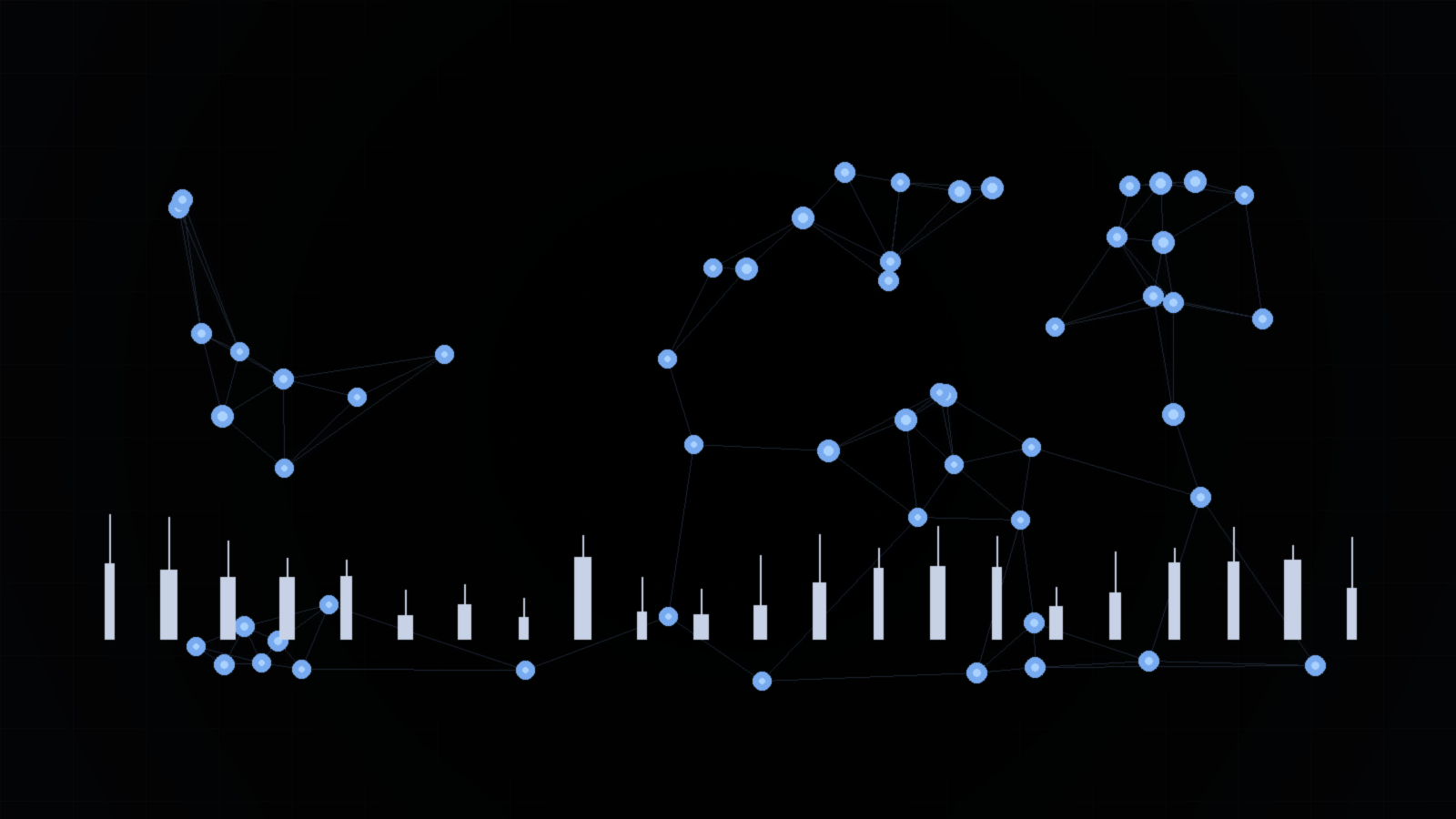

In markets, regulation is wiring.

When the wiring changes, the behavior of the entire system changes—

even if the asset, the tech, and the narrative stay the same.

This post is a simple map of how that happens.

The “3-year-old” version

Imagine a playground.

- Kids want to play (traders, builders, investors)

- Toys are the assets (BTC, ETH, tokens)

- The playground layout is market structure (venues, custody, settlement, rails)

- Teachers & rules are regulation (who can do what, where, and with what constraints)

If the teacher moves the slide, changes the rules for the swings, or adds fences…

the whole playground behaves differently.

That’s regulation. It doesn’t just change outcomes. It changes paths.

Regulation changes markets through 5 levers

- Who is allowed to participate

- Which institutions can touch what, and under what conditions.

- Where activity is forced to route

- Onshore vs offshore venues, KYC rails, approved intermediaries.

- What counts as “safe” custody

- Who holds the keys, what is segregated, what is rehypothecated, what is insured.

- How settlement is treated under stress

- Finality, reversibility, cut-offs, and what happens when liquidity disappears.

- What behavior is rewarded by compliance

- Incentives shift from “best execution” to “least regulatory friction.”

This is why the same asset can trade like a wild frontier one year…

and like a regulated utility the next.

The important mental model

Markets don’t just move on information.

They move on constraints.

A constraint is a “you can’t do that anymore.”

When constraints change, the strategy set changes, and the entire market re-optimizes.

That re-optimization is what people experience as:

- liquidity “improving” or “drying up”

- spreads tightening or widening

- volatility compressing or exploding

- custody risk appearing out of nowhere

Those aren’t moods. They’re structure reacting to new boundaries.

What Advanced members get that the public won’t

Public posts explain the map.

Advanced gets the instrument panel:

- Liquidity stress signals beyond price

- Custody & counterparty structure under real-world constraints

- Institutional routing and “regulatory flow” effects

- Early standards drafts as they evolve (before they’re public)

- Private dashboards as we build them (so you can see the system change in real time)

If you want to understand systems the way institutions do—

you don’t watch the headline.

You watch the plumbing.

Start with the map

If this way of thinking clicks, begin with how we analyze systems:

- Methodology — how Blockchain University studies incentives, structure, and failure modes

/methodology/ - Reference Index — the living map of our frameworks, research, and standards

/reference/

These pages are public and designed to help you understand how to think, not what to trade.

Go deeper (Advanced)

Advanced members get access to the material behind the public map:

- Subscriber briefings on liquidity stress, custody risk, and institutional structure

- Early standards drafts before public release

- Private dashboards as they are developed

- Research written for decision-makers, not spectators

This is where system-level insight turns into operational understanding.